April 2024 Capital Projects Bond

Bond Community Oversight Committee

- Description - Bond Community Oversight Committee

- Application - Bond Community Oversight Committee - still accepting applications

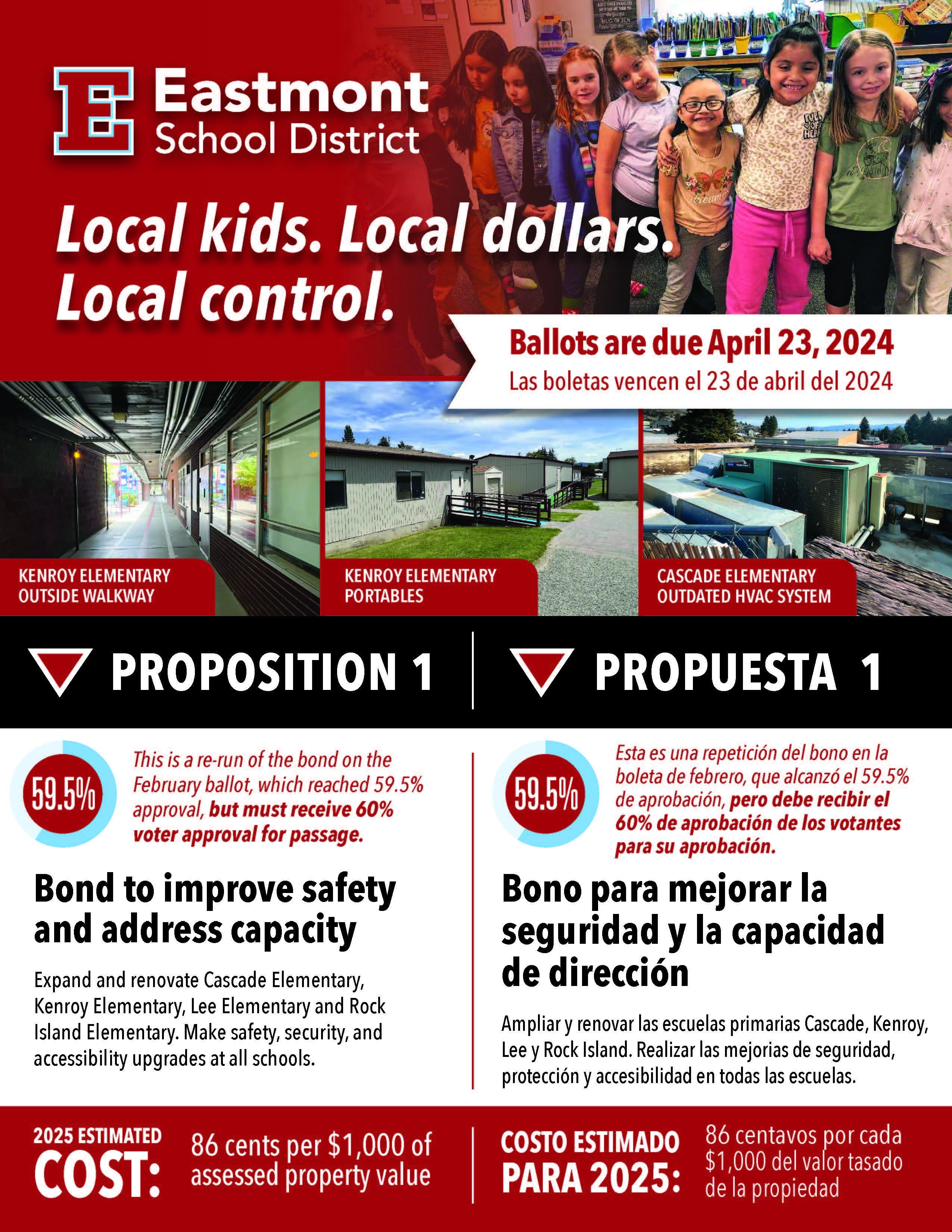

You spoke, we listened. Thank you to the hundreds of community members who shared their input to help us develop and prioritize this updated funding measure. The updated 2024 bond is significantly less than the 2022 bond proposal, and would address only our immediate facilities needs.

Funding from this bond would be used to address:

- Safe Learning Environments

- Cascade and Kenroy Elementary Schools were built as a series of separate buildings. This means that nearly every classroom has an exterior door, forcing students to use outdoor walkways and making it time-consuming to secure the building if needed.

- We rely on 15 portable classrooms to address crowding at three elementary schools. Nearly 375 students must use these classrooms. While the portables themselves are safe, the exterior entrances and separation from the main school cause supervision and security issues.

- Building Conditions

- The average age of Cascade, Kenroy, Lee and Rock Island Elementary Schools is well over 60 years old. A lot has changed about classroom learning in the time since they were built. New buildings would allow for updated technology, small group learning spaces to meet the needs of every student, and safer student drop-off and pick-up.

- The HVAC, plumbing and other systems in these four buildings are past their usable lifetime. They are costly to maintain. While our staff do their best to keep our buildings running, these building systems are now obsolete. Newer buildings would be easier and cheaper to repair and maintain.

- 15 portables have reached or exceeded their expected 25-30 year life span, some by over a decade.

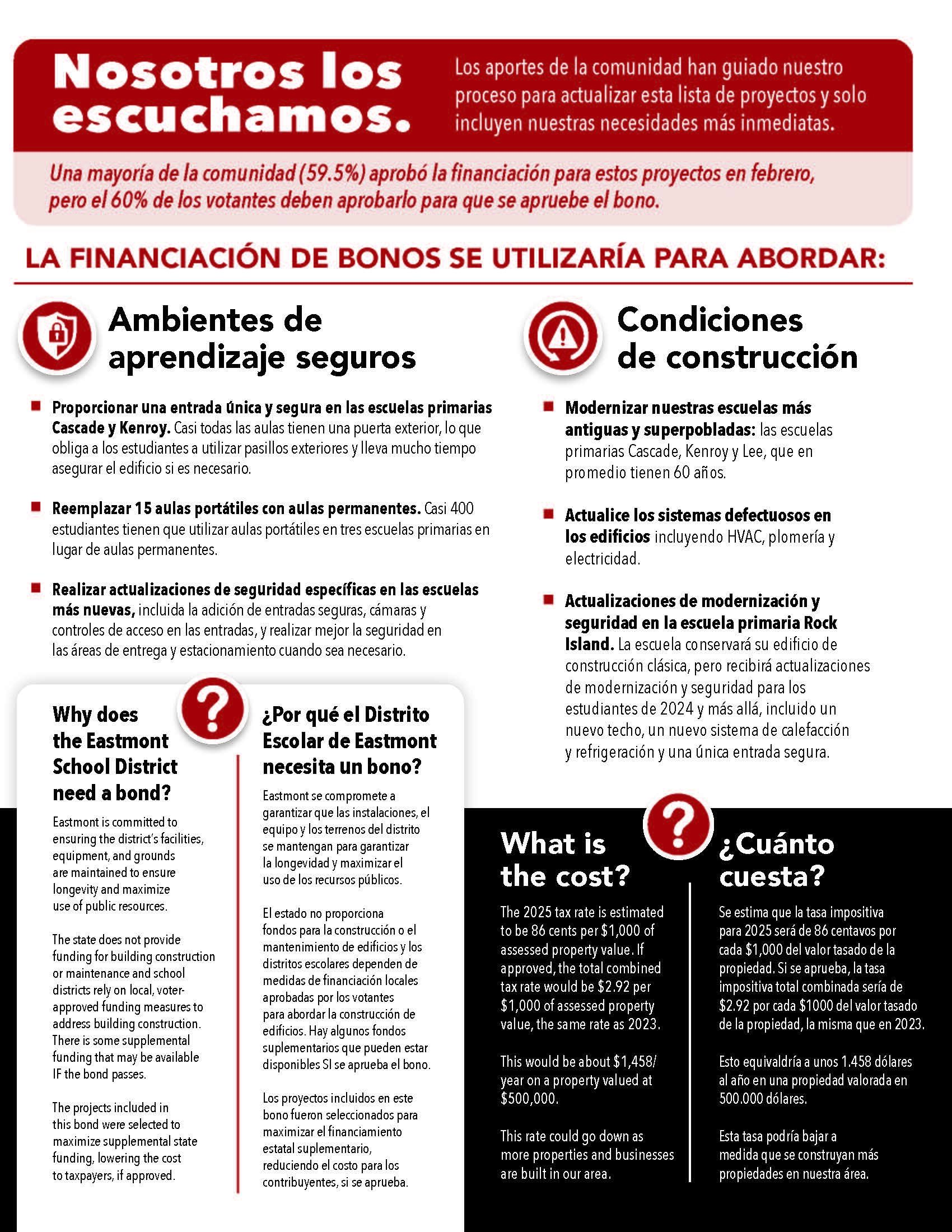

Why does Eastmont need a capital projects bond?

The state provides very little funding for construction or repairs of school buildings. The state will occasionally provide supplemental funds, depending on the age and condition of a building, but only if the bond measure is approved by the community. School districts rely on local, voter-approved bonds and levies to fund the projects and programs not funded by the state.

This funding stays in our community to support Eastmont students.

Click here for our Eastmont Community April Bond Presentation 2024!

What is the cost?

With the reduced project list from the 2022 bond, our financial planners have created a bond schedule that will keep the tax rate the same as the 2023 rate. If approved, there will be no change to the combined tax rate of $2.92 per 1,000 of assessed property value.

This rate could decrease as more properties and businesses are built in our area.

The total amount of the bond is $117.1 million, and if approved, would generate a supplemental $20.1 million from the state (which would not impact tax rates).

FAQ

Q1: I heard in the news Eastmont is getting money from the state for construction (OR School districts are fully funded)

A1: The state provides money for construction ONLY IF a bond passes. The state has a formula that takes the building conditions into account to provide an amount of supplemental funding. That amount of potential money did increase, and the district would only receive it if the bond passes.

IF the bond passes and we receive the supplemental state funding, it would provide funding for unforeseen contingencies. This allows us to guarantee the quality product that our community expects. We would also potentially look at lowering the amount of taxes paid by our local community, if there are remaining unspent funds.

Q2: If my property value goes up, does the district get more money?

A2: No. Voters approve a total amount of money for the district to collect. As property values go up or as more properties are built in our area, the tax rate you pay for the district’s funding measures actually goes down.

Q3: Didn't the district just ask for this bond?

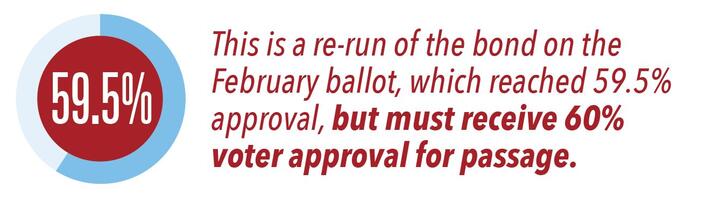

A3: Yes, this is the same bond that was on the February 13 ballot. A majority (59.5%) of our community voted in favor of this measure, but bonds must receive 60% voter approval to pass. We believed we owed it to the majority of the community who favored this proposal to bring it in front of voters again. We were just 34 votes short of the 60% requirement.

Q4: How does this tax rate work?

A4: Voters approve a total amount to be collected by the district, not a tax rate. Tax rate may fluctuate based on new people moving into the community and buying property, and new businesses adding to the tax roles, (i.e. Microsoft Server Farms, Amazon Last Mile Distribution Center). The tax rate will not exceed $2.92/$1000 of assessed property value, and will most likely be lower than that. Our 2023 taxes were the same rate of $2.92/$1000 of assessed value.

Q5: What is your back up plan if this should not reach the 60% approval rate as required by law.

A5: This is our backup plan. The scope of the projects has been greatly reduced from the November election, and the amount of the bond has been greatly reduced from then as well. The work needed at these four buildings are a great need, not at all a 'nice to have'.